New Intel and Marketing Solutions Revealed at T3 in San Diego

New Intel and Marketing Solutions Revealed at T3 in San Diego

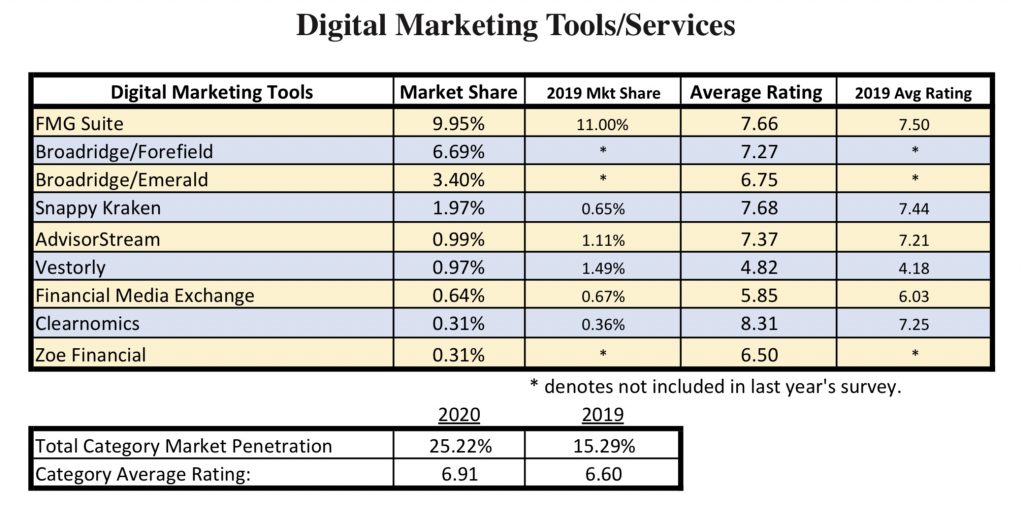

In the 2020 T3/Inside Information Software Survey for Financial Advisors — which with 5175 valid responses is the largest survey of its kind — released at the T3 Technology Conference (a.k.a. T3 Advisor), a quarter of all the advisory firms that replied said they are making use of digital marketing tools to grow their businesses.

The FMG Suite , which offers content, website design and social media tools, once again is listed as the market leader, and its 7.66 user rating suggests that its users are happy with the service. This year the producers of the survey, Bob Veres and Joel Bruckenstein, included Broadridge’s Forefield (content, lead optimization and digital advertising) and Emerald (website design) services, and they finished second and third in the category, with a combined market share that was actually greater than FMG. Snappy Kraken is the relative newcomer to the group, with the fourth highest market share, and a very high 7.68 average user rating. In all, the category rating rose, despite including one of the few satisfaction scores in the survey to come in below 5.00.

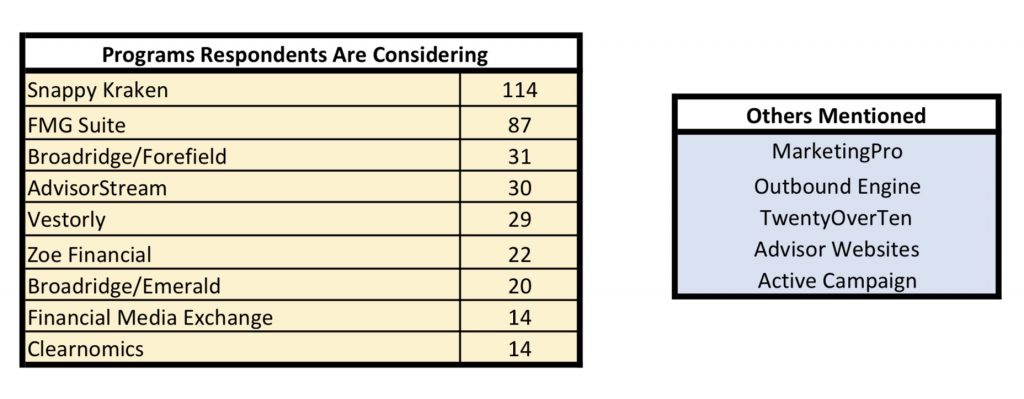

Looking at the programs that the survey respondents are considering (see graphic below) it is clear that Snappy Kraken, which provides a highly automated marketing solution, has gotten the attention of the advisor marketplace, with FMG Suite in second place.

At the T3 Advisor Conference held February 17-20, 2020 in San Diego, where 798 participants enjoyed a plethora of educational sessions and demos in exhibit hall booths, Twenty Over Ten, a SaaS marketing solution for financial advisors, formally launched Lead Pilot, one of the industry’s first-ever AI-powered all-in-one solution for content creation and distribution.

“Since starting Twenty Over Ten, we’ve said there are two mega-trends that would shape the future of advisor sales and marketing: personalization and automation,” said Ryan Russell, founder and CEO of Twenty Over Ten.

“Over the last few years we’ve built an industry-leading website platform, and now we’re expanding our offering by launching a turnkey inbound marketing platform. This new product gives financial advisors an all-in-one, intuitive platform to dramatically increase the number of leads and simplify the entire inbound marketing process.”

With the addition of Lead Pilot, Twenty Over Ten will be competing more closely with FMG Suite and the Broadridge digital solutions.

FMG Suite, a company that provides websites as well as a cloud-based marketing automation platform for financial service professionals, announced at the 2020 T3 Advisor Conference the addition of Curator™ – an artificial intelligence-powered engine – to its content library. Over time, Curator™ uses machine learning to fine-tune its content recommendations based on the articles the financial professional chooses to share, audience engagement with those articles, and compliance actions. By sharing content that reflects their unique personal and professional interests, FMG Suite is helping its customers build stronger and more lasting relationships with their clients and prospects.

“FMG Suite empowers advisors to grow their businesses through extraordinary marketing,” said Scott White, FMG Suite CEO. “Our platform seamlessly automates marketing communications that deepen our customers’ relationships with their clients and prospects to directly impact their bottom line. FMG Suite is a must-have marketing solution for the modern financial advisor.”

Snappy Kraken, a MarTech company focused on helping financial professionals automate their marketing and business processes, in January 2020 released a comprehensive analysis of investment advisor marketing trends based on more than 9.3 million data points gleaned from real marketing campaigns initiated over the past year. Robert Sofia, co-founder and CEO of Snappy Kraken, while at the 2020 T3 Advisor Conference delivered a main stage presentation on the findings. In his presentation, “Marketing Hacked – Data From 14,000 Advisor Campaigns That Proves What Works (and Doesn’t), Sofia urged advisors to work on collecting email addresses for their marketing campaigns. He also revealed online traffic sources that produce the strongest results, and how to maximize ROI with minimal spend; the types of content and subject matter that attract the most prospects and engage current clients and provided insights into why this content is effective; and what to expect from marketing efforts based on analytical marketing performance benchmarks.

“Email was by far the primary driver of traffic to advisor websites and, consequently, lead generation. An overwhelming 69% of the traffic generated by 14,299 Snappy Kraken campaigns came from emails, followed my social media ads (17%) and organic social media (16%). Out of all the traffic generated by social media, 67% came from Facebook, 26% from LinkedIn and only 7% from Twitter, according to the report. Marketing is not a singular event; it’s an ongoing process involving a symphony of actions,” said Sofia in his presentation at T3. “The people that are getting better results from marketing are doing more marketing,” he said. “The marketers with the most success also posted more personal information to social media and were outspoken about having a family and it being a priority of theirs, which was interesting.”

Indyfin, a newcomer to the finserve marketing solutions space, issued to coincide with the 2020 T3 Advisor Conference a news release about their new lead generation and appointment setting service. According to the news release, Indyfin takes the risk out of sourcing leads for financial advisors by providing them with introductions; there is no cost to the advisor until the prospect becomes a client. By using their groundbreaking technology and proven approach, Indyfin translates leads into “live” phone introductions and in-person meetings. Once a lead becomes a prospect, Indyfin shares revenue with the advisor for a set period of time, not in perpetuity which is how some other revenue-sharing lead gen services work. Right now, Indyfin is only working with advisors in Texas, but once traction is achieved in Texas, other states (and corresponding registrations/licenses) will be opened.

While Indyfin was not an official T3 sponsor and thus did not have a booth or a speaking slot (the T3 sponsorship opportunities sold out months prior to the conference and the T3 speaking slots were filled to overflowing), Indyfin decided to attend the conference as a way to be a part of the T3 community and to cross-pollinate with other marketing solutions firms such as TwentyOverTen, FMG Suite and Snappy Kraken. Indyfin is in the process of working out strategic partnerships with a number of marketing automation and content production companies, industry associations, finserve/fintech consultants, custodians and broker/dealers.

Indyfin will be competing against other marketing solicitors such as SmartAsset, Wealthramp, Harness Wealth, and Zoe Financial (Zoe made the T3/Inside Information Survey chart for the first time this year). These services match consumers in need with pre-vetted financial advisors and then share revenue with the advisor; this is similar to lead generation arrangements from RIA custodians like Schwab, Fidelity and TD Ameritrade where they receive a slice of client revenue “ostensibly by registering as an RIA solicitor for the advisors on its platform,” says Michael Kitces in this article.

“Indyfin is redefining how the wealth management industry connects with future clients,” said founder and CEO, Akshay Singh. “Unlike traditional lead-gen services, we don’t charge advisors for leads. Financial advisors who use the platform start receiving customer leads from the best possible sources at no cost immediately upon joining the Indyfin family, and don’t pay for introductions until they actually become clients – meaning no upfront risk for advisors.”