Pershing Disrupts the RIA Custodial Sector with Wove

Pershing Disrupts the RIA Custodial Sector with Wove

A multi-custodial, open architecture operating system

By Joel Bruckenstein, CFP

In an era of rapid technological advancements and evolving investor expectations, Pershing X, a fintech business that launched approximately eighteen months ago as a unit within BNY Mellon Pershing, has launched Wove, an innovative, multi-custodial operating system. It is designed to empower wealth managers and transform the landscape of wealth management. With its robust features and comprehensive capabilities, Wove has the potential to revolutionize the way financial professionals engage with clients, deliver personalized advice, and streamline operations.

Wove places clients at the center of the wealth management process, enabling advisors to deliver tailored solutions and personalized experiences. By harnessing advanced data analytics, artificial intelligence, and machine learning algorithms, Wove empowers advisors to gain deep insights into their clients’ financial goals, risk profiles, and preferences. This invaluable knowledge allows advisors to develop highly customized investment strategies that align with individual client needs.

Wove offers a user-friendly interface that simplifies complex financial information and presents it in a visually appealing and easy-to-understand manner. The platform’s intuitive design enables wealth managers to access real-time data, performance metrics, and portfolio analysis, thereby facilitating informed decision-making and efficient portfolio management.

Wove understands the importance of effective communication and collaboration between advisors and their clients. The platform facilitates secure and streamlined communication channels, allowing advisors to engage with clients in real-time through a variety of mediums, including video conferencing, chat functions, and document sharing.

Furthermore, Wove supports multi-channel interactions, enabling clients to access their financial information and communicate with their advisors using their preferred devices, whether it be a computer, tablet, or smartphone. This flexibility ensures seamless collaboration and strengthens the advisor-client relationship, fostering trust and enhancing overall client satisfaction.

Recognizing the significance of operational efficiency and compliance within the wealth management industry, Wove integrates powerful tools that automate repetitive tasks and ensure adherence to regulatory requirements. By leveraging advanced technologies like robotic process automation and smart workflows, the platform streamlines administrative processes, reduces manual errors, and frees up valuable time for advisors to focus on delivering personalized advice and building meaningful client relationships.

“Most advisors have chosen 10 or 12 applications they need to do their work, and then they will try to have them talk to each other, but it never works,” said Ainslie Simmonds, President of Pershing X. Wove is designed as an operating system where all of an advisors’ apps work seamlessly together.

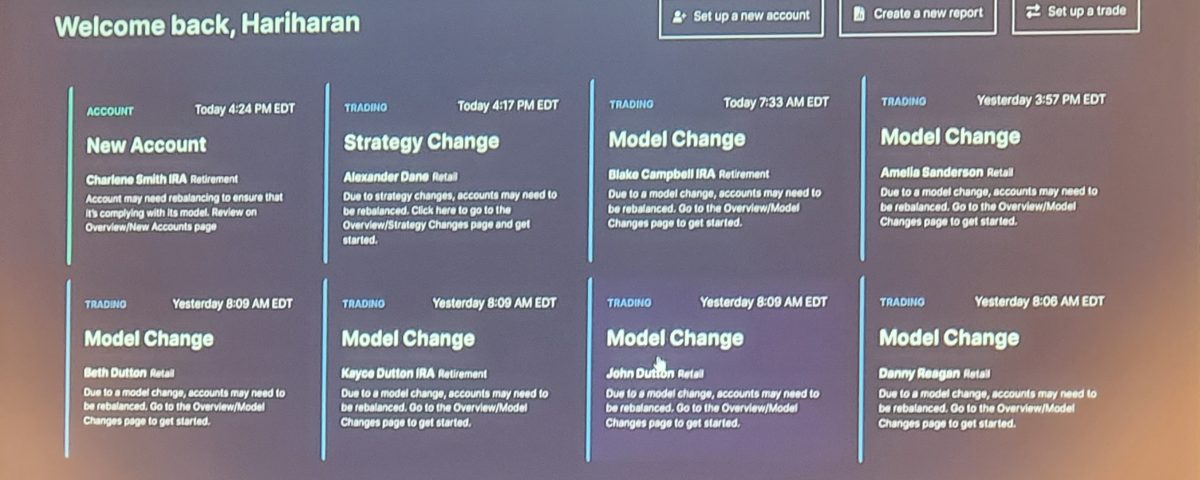

The Wove application is designed to support not just applications, but the entire advisor workflow. When you launch Wove, you land on a dashboard that has alerts in the form of cards. Today, the alerts are limited to native Wove apps, including new account alerts, model change alerts, strategy change alerts, withdrawal notifications and the like, but soon, their party notifications form the planning software and other applications will appear on the dashboard as well. When you click on a card, it takes you, in context, to the Wove screen that requires your attention.

Advisors can monitor clients and prospects through integration with several CRM applications including Salesforce, Redtail and Wealthbox. When meeting with a prospect, advisors can generate a full investment proposal using mutual funds, EFT’s, SMA’s and individual stocks. Wove has an extensive toolset that allows advisors to build and manage models by leveraging a long list of asset manager models in addition to their own.. They can also avail themselves of direct indexing investment strategies, including the new BNY Mellon Precision Direct Indexing S&P 500 (Wove supports fractional shares and trades in dollar amounts). The strategy seeks to match the performance of the S&P 500 Index and enables advisors to offer clients customized solutions. Advisors can also illustrate to clients how taxable accounts can be transitioned immediately or over time to minimize the impact of taxes using built in tax transitioning tools.

Once the prospect agrees to become a client, the advisor can open multiple accounts with multiple custodians without the need to re-key any data. If the information necessary to populate a field already resides within the system, Wove will automatically populate it. If the advisor needs to key the data into one form, that data will be pre-populated within all subsequent forms. Pershing includes Schwab and Fidelity as part of the initial version. It is not clear at this time which, if any, additional custodians will be included. The client will receive a single package of documents that can be signed and returned electronically. Once the account is opened and funded, the advisor can implement the portfolio right from within Wove.

Wove currently supports two financial planning applications: MoneyGuidePro and Conquest. For those unfamiliar with the latter, it is a new, AI powered financial planning application, the first truly innovative new professional financial planning application that I’ve seen in a decade. Conquest was founded by Dr. Mark Evans, the founder of EISI, the developers of NaviPlan. Under Evan’s guidance, EISI became the largest distributor of financial planning software in North America. He exited that business in 2011.

For those advisors who prefer to first create a financial plan and then move into the portfolio construction and implementation phase, Wove supports that workflow as well. You can launch a plan, determine risk tolerance, determine the appropriate asset allocation, and then move to the investment section to finalize the plan and implement it.

Wove supports two billing modules: Redi2 and PureFacts. The latter generated a great deal of buzz at the recent Insite Conference.

Our initial impressions of Wove were highly favorable. To our knowledge, no other custodian offers such a seamless, multi-custodial operating system that supports end-to-end advisor workflows. That said, there is still work to be done.

Multi-custodial capabilities are not yet fully built out. Today, notifications are limited to the native Wove applications. Straight through processing of trades is not yet fully built out either, nor is location sensitive, tax sensitive rebalancing at the household level. Pershing has made it clear that the list of third-party applications added to the system will be best of breed. They do not anticipate adding almost all comers as TD Ameritrade did. That said, there are some best of breed providers that have not yet been added.

To date, not much has been said about pricing. We know that there will be a fee for the base platform, and that there will be an additional charge for premium modules. The managed account portion of the platform will continue to charge as Lockwood did in the past. So, prices may vary significantly depending on your Wove configuration.

Putting things in perspective, this is clearly version 1.0 of Wave, and Pershing X has delivered quite a bit in a very short period of time. We have no doubt that they will continue to build upon this very strong opening salvo in the coming months.

The debut of Wave is an impressive one. If Pershing X can continue to build on their initial success at a similar pace going forward, Wove will be a force to be reckoned with in the future.