Technology has Failed to Increase Advisors’ Efficiency – Here’s Why (and How to Fix the Problem)

Technology has Failed to Increase Advisors’ Efficiency – Here’s Why (and How to Fix the Problem)

While pursuing new product offerings and market supremacy, fintech platforms seem to have forgotten to try and make advisors’ lives easier. Some companies are hellbent on bringing tools, not value, to advisors and their clients. They’re fascinated with automating things, but delve no deeper.

The problem is, it’s not really possible for advisors to endlessly transfer data from one tool to another by hand‚ and this routine task would seem to be the number-one candidate for automation. Yet, regardless of its vital importance, integration continues to be the number-one problem for platforms.

In addition, for most advisors, the availability of so many options in the market means they have to be experts in every tool their clients want to utilize. It takes them time to explore tools, and leaves them open to the risk of mistakes and could cost them dearly if/when employees take their knowledge with them.

Advisors who are mired down with their technology and practice management, are probably failing to provide their clients with the great service they deserve – and that these well-intentioned advisors envision. Advisors should be thinking about what their clients really need and want and, with focused determination, working to deliver financial freedom through a modern, elegant platform. It might be no small task to streamline all integrations into one smooth workflow, so it’s best left to true professionals. Also, it’s worth looking for technology that provides open APIs so that more platforms can integrate with your hand-picked solutions.

Is a One-Stop Operation Center the Solution?

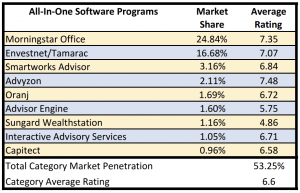

Solutions such as AdvisorEngine, Advyzon, Capitect, Envestnet|Tamarac, Interactive Advisory Services, Morningstar Office, Oranj, Sunguard Wealthstation and Cetera’s Smartworks Advisor are already on the road to creating a one-stop hub for managing all accounts through one interface. These platforms minimize the need for training and could increase the level of access, which gives advisors latitude.

To download a copy of the 2019 Technology Survey produced by Bob Veres and Joel Bruckenstein, click the graphic shown.

To download a copy of the 2019 Technology Survey produced by Bob Veres and Joel Bruckenstein, click the graphic shown.

Of course, it’s not a revelation that advisors are now overwhelmed with data. For them to save time on adaptation and get value quicker, platforms can automate the division of clients into several profiles and customize offerings according to the specific goals clients are pursuing. For example, if a client wants a simple retirement plan, their offering won’t include complex analytics. So platforms can split clients into groups based on what system triggers say, and provide only those options that correspond to clients’ specific needs.

The main takeaway to consider here is that fintech tools have accelerated some aspects of advisors’ work, but also added hassle in terms of data transfer and training of staff. It’s worth focusing on platforms that eliminate the irksome aspects and bring value while introducing genuine automation, integration and innovation.