How eMoney Advisor Strategically Transformed Their Client Onboarding Experience

How eMoney Advisor Strategically Transformed Their Client Onboarding Experience

The financial technology industry is going through a transformation that is making customer success seamless and effortless. eMoney Advisor is a leader in revolutionizing how clients engage with their financial advisors thanks to new real-time guidance interaction. eMoney creates scalable wealth management technology that transforms the way financial professionals deliver advice and build collaborative relationships with their clients. Today, eMoney aggregates more than $2.5 trillion dollars in assets for more than 45,000 financial professionals, serving 1.9 million end-clients.

Below you will find a transcript of a conversation that Emilia D’Anzica, WalkMe’s VP of Customer Engagement, had with eMoney’s Director of Client Engagement, Kelsey Cartmill, and Director of Training, Leah Simoglou. They discuss the role of WalkMe’s DIgital Adoption Platform in their business strategy across client and financial advisor relations.

Following the Q&A Transcript you will find screenshots of WalkMe on the eMoney Platform.

~ Joel Bruckenstein, Producer, T3 Technology Tools for Today Conferences and T3 Technology Hub

Q&A TRANSCRIPT

D’Anzica: What challenges did eMoney experience with the client onboarding experience?

Cartmill: eMoney’s challenge with onboarding revolved around a lack of a comprehensive virtual learning experience for our end users. This void resulted in high call volumes, as appointments with Success Coaches turned into training sessions on how to use the software, as opposed to being focused on best practice strategies and how to efficiently and effectively succeed with the eMoney Platform.

D’Anzica: When seeking a Digital Adoption Platform (DAP) solution, what requirements were most important to eMoney and its customers?

Simoglou: eMoney required a platform that served as a learning management system (LMS) that was easy to navigate, can live as an overlay on the eMoney application, can provide gamification, and is able to generate business insights on which users were completing training modules. eMoney aimed to eliminate the tedious point-and-click training aspect of our software, and shift client sessions with Success Coaches away from administrative tasks to meaningful and strategic conversations.

D’Anzica: How did you implement WalkMe’s TeachMe Application in eMoney platform?

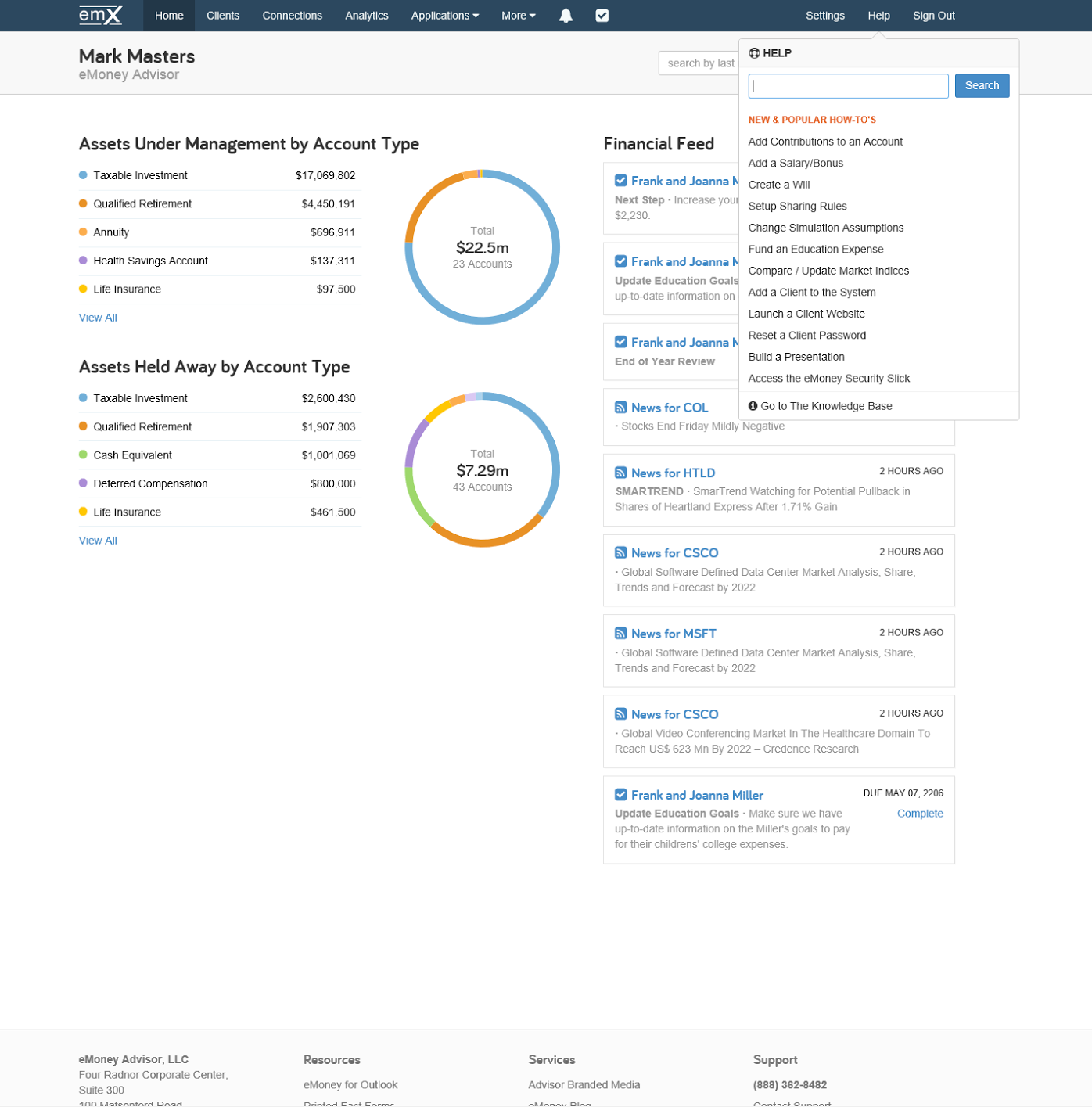

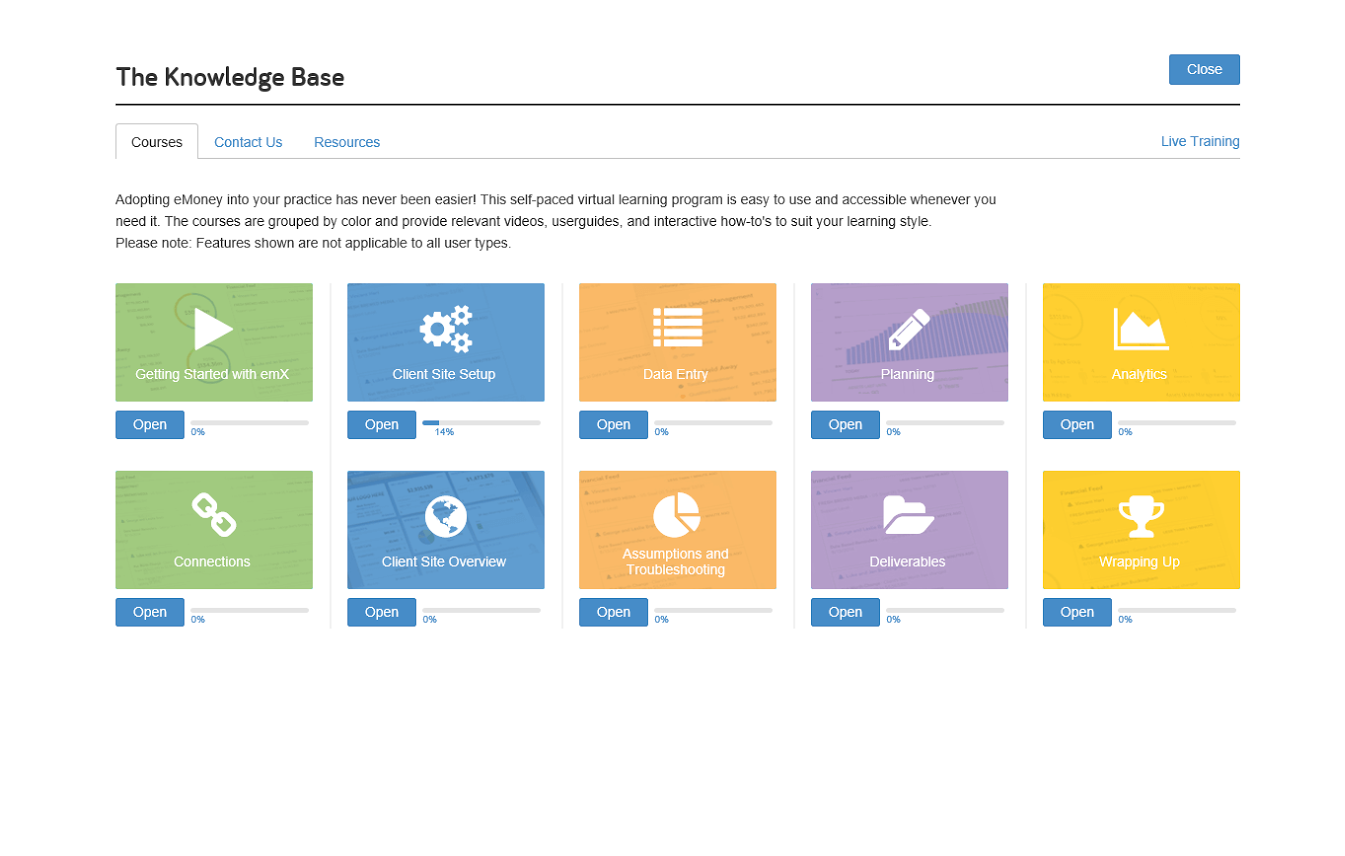

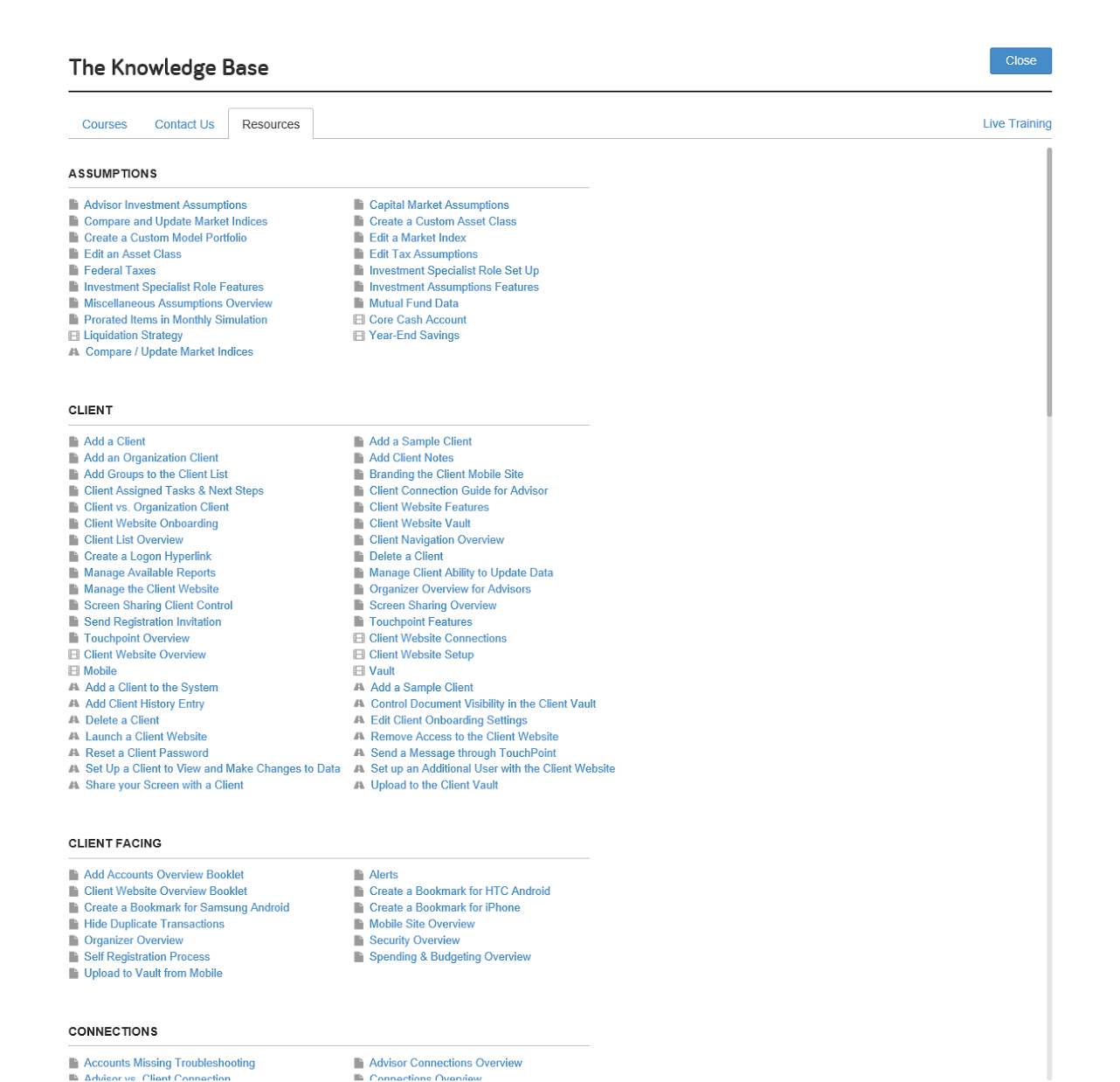

Simoglou: WalkMe has been an integral part of our strategy to make user adoption efficient yet effortless. We created an external LMS utilizing TeachMe that now lives in eMoney’s Help menu. This comprehensive virtual onboarding guide is comprised of video, PDF, and Walk-Thru content designed to engage and interact with our end users while they complete their training.

With the help of WalkMe’s team, we have created 10 different courses in TeachMe that mimic the training process that users would typically go through with their Success Coach. We were also able to add in a Search functionality within the Help menu that allows the users to easily identify and access all of our resources in one widget. By utilizing TeachMe, we have created an entire course structure with 80+ Walk-Thru’s and over 200 resources for bringing all new users up to speed.

eMoney is not designed to be a one-size fits all financial planning solution; our success depends on having the user experience personalized to the customer. We were able to create customized course work within TeachMe, that users completed, then were able to discuss in a session with a Success Coach. In that session, they are able to receive relevant guidance on how to apply these lessons in real time to their business.

D’Anzica: Can you explain how eMoney’s business has benefited from implementing WalkMe?

Cartmill: It’s only been up and running for a few months, and in that short time we’ve already seen tremendous engagement. Most of our users seem to be power users in that of all of our clients who have logged in, 80% have logged in over the last week and 92 percent have logged in over the last month or so. Clients are really motivated to learn the basics from WalkMe. As a result, our success coaching sessions with clients have become more meaningful. WalkMe has allowed eMoney’s client onboarding program to become seamless and efficient and overall, further strengthening our relationships with clients and empowering them to get the most of our technology.

D’Anzica: What is your vision for going forward with scaling your onboarding processes as your client base grows?

Simoglou: With WalkMe’s help, we are able to scale and personalize training across a massive group of advisors with very different needs, while still maintaining a solution that strengthens the advisor/client relationship. Even as the number of advisors that utilize eMoney’s platform grows, the defining principle of eMoney’s existence will always remain consistent: unwavering dedication to helping advisors and their clients achieve success. WalkMe helps us achieve that goal.